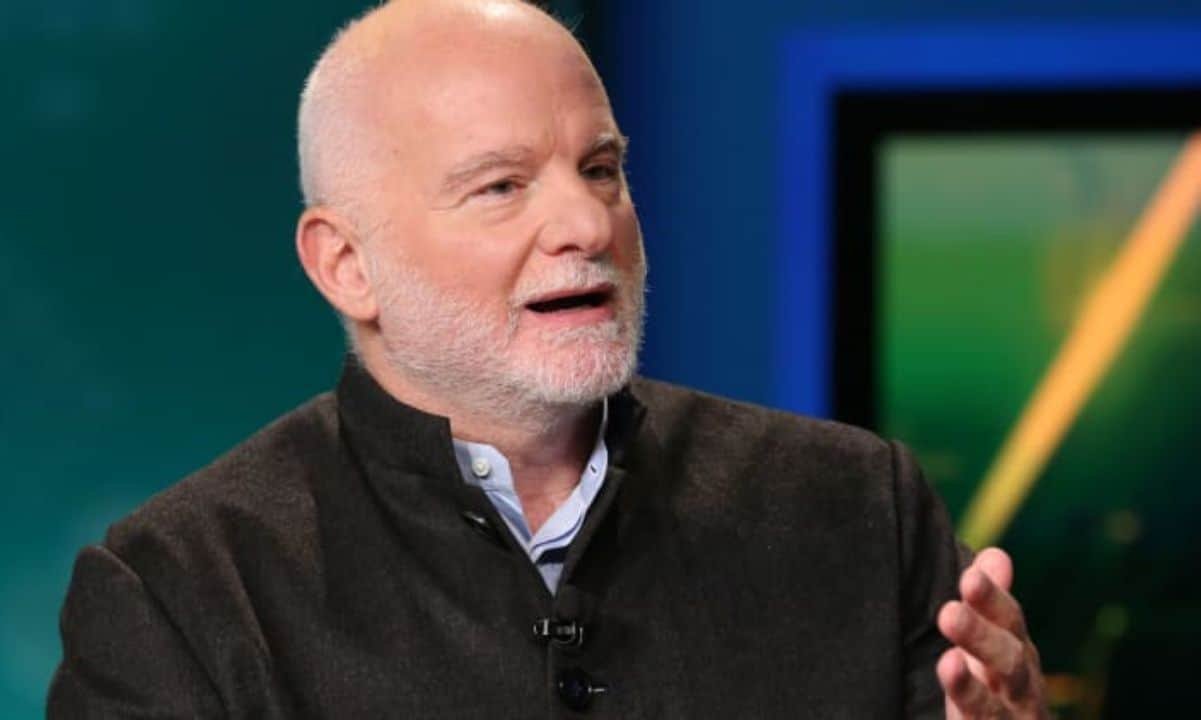

Michael Sonnenfeldt, Chairman of Tiger21, a global network of ultra-wealthy investors, has disclosed that the firm holds approximately $6 billion in cryptocurrency.

He also stated that the network of high-net-worth investors remains bullish on Bitcoin.

The Ultra-Wealthy Are Bullish on BTC

“We have about 1% to 3% of $200 billion in assets, so about $6 billion in assets, in digital currencies,” he said in an interview with CNBC.

When asked about the investment preferences of Tiger21’s members, he responded, “The areas of digital currencies remain really exciting,” adding that some individuals within the firm are “all in” on the asset class. Sonnenfeldt compared Bitcoin to gold, highlighting the former’s increasing acceptance as a store of value.

He explained that both assets were often seen as serving the same purpose, stating, “They’re perceived as storehouses of value that are not subject to government fiat.” According to him, the only difference is that gold is favored by traditionalists, while Bitcoin has a more modern appeal.

The executive also stressed that in a truly global market, people felt there was a genuine refuge to be found in such investments. He gave examples of how citizens in economically distressed countries such as Argentina and Lebanon turn to Bitcoin to protect their wealth, showing its growing role as a hedge against instability.

As mentioned in the interview, Tiger21 manages approximately $200 billion in assets and has around 1,600 high-net-worth investors among its members. To join the investment group, participants are required to have at least $20 million in liquid assets.

Sonnenfeldt stated that nearly 80% of the company’s portfolio is allocated to “long-only risk-on assets” such as public and private real estate and private equity. He also noted that the firm’s cash position has dropped below 10% for the first time in 17 years.

A Favorable Environment

Since President Donald Trump returned to the White House, Bitcoin has experienced a significant surge. The politician has expressed support for crypto projects and even suggested the possibility of the U.S. creating a strategic Bitcoin reserve.

The idea gained even more traction when Trump issued an executive order to establish a sovereign wealth fund, which proponents like Cynthia Lummis believe can be used to buy the cryptocurrency.

However, despite the overall optimism, the market has faced some setbacks due to the U.S. President’s imposition of tariffs on some of the country’s trading partners. His action caused jitters among investors, leading to approximately $400 billion being wiped out from the crypto market cap within 24 hours.

Nonetheless, Tiger21’s $6 billion investment in the sector is indicative of a broader trend of institutional investors increasing their allocations to digital assets as the regulatory environment in the United States becomes more defined under Trump’s administration.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!